Getting Started with BankVision

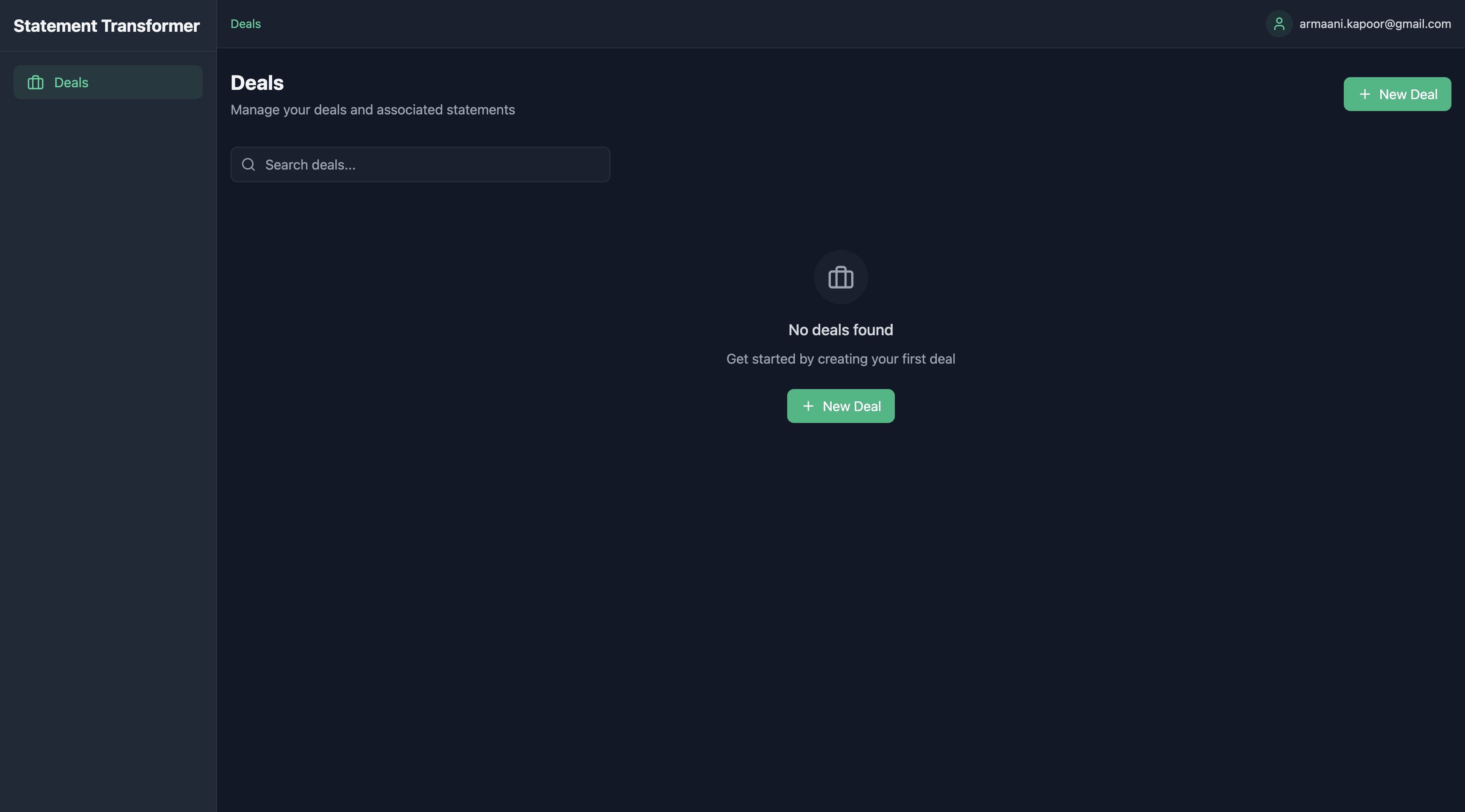

Follow this guide to create your first deal and start processing financial documents. We’ll walk through the entire workflow using a sample deal.Step 1: Your Deal Dashboard

When you first log in to BankVision, you’ll land on your deal dashboard. This is your command center for managing all your financial document processing: The dashboard starts empty, but don’t worry - we’ll create your first deal in just a moment. Click the “New Deal” button in the top right to get started.

The dashboard starts empty, but don’t worry - we’ll create your first deal in just a moment. Click the “New Deal” button in the top right to get started.

How Deals Work in BankVision

How Deals Work in BankVision

In BankVision, a deal represents a merchant’s funding application. Each deal organizes financial data, automates analysis, and streamlines underwriting workflows.

Deal Workflow

Merchant Data Extraction

Business Information

Business Information

- Entity Name & Type

- Industry Classification

- Tax ID & Incorporation State

Financial Insights

Financial Insights

- Gross Deposits

- Cash Flow Trends

- Existing Obligations

Owner Details

Owner Details

- Name & Ownership Percentage

- Contact Information

Best Practices

Complete Applications

Complete Applications

- Ensure all fields are filled

- Verify uploaded documents

- Confirm contact details

Document Quality

Document Quality

- Upload full statement sets

- Ensure legibility & accuracy

- Verify correct date ranges

Efficient Deal Management

Efficient Deal Management

- Keep status updates current

- Review documents promptly

- Maintain clear notes & logs

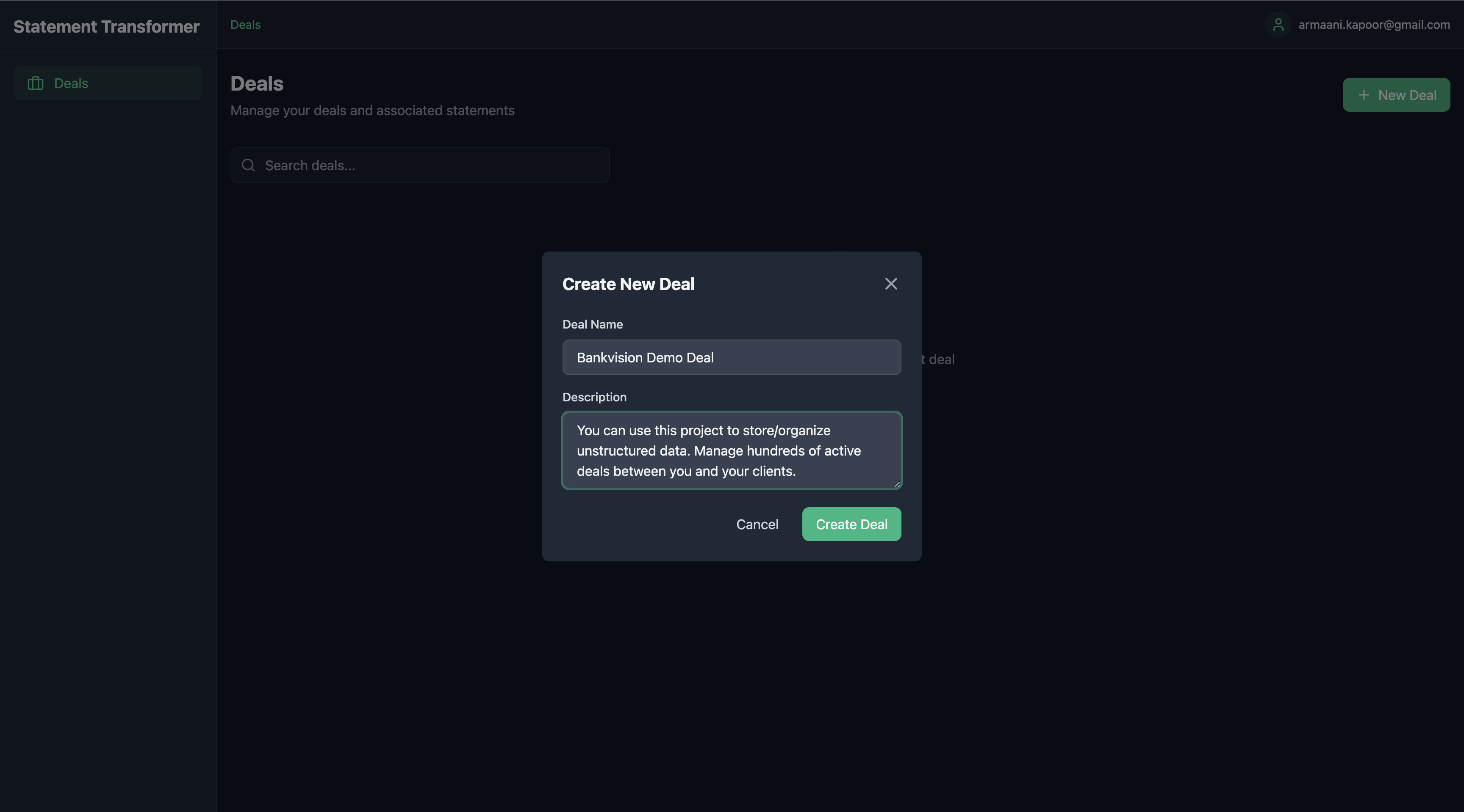

Step 2: Creating Your First Deal

When creating a new deal, you’ll see a form where you can enter the deal details. Here’s an example of how you might fill it out: Fill in:

Fill in:

- Deal Name: Give your deal a descriptive name

- Description: Add any relevant notes or context

- Click “Create Deal” to proceed

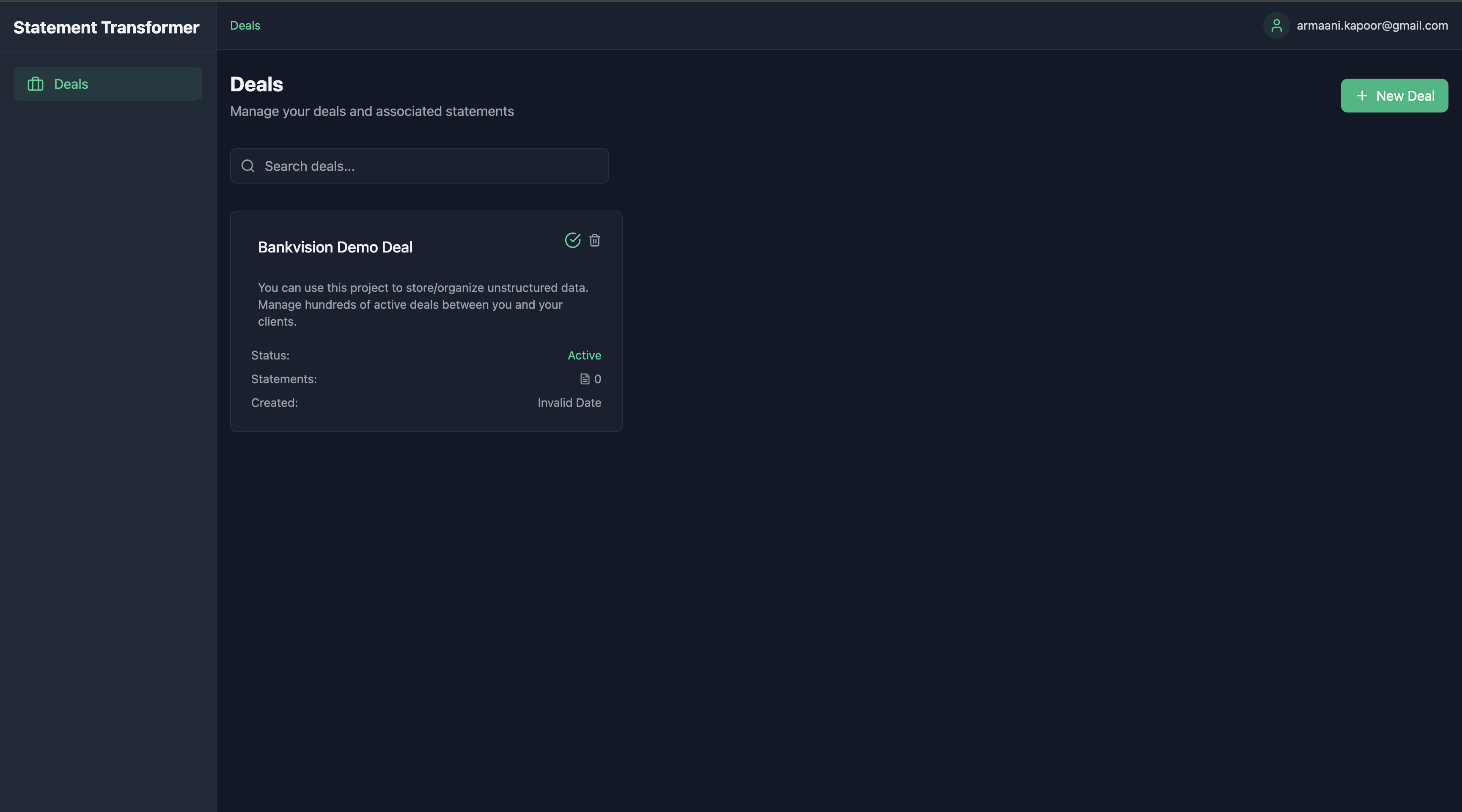

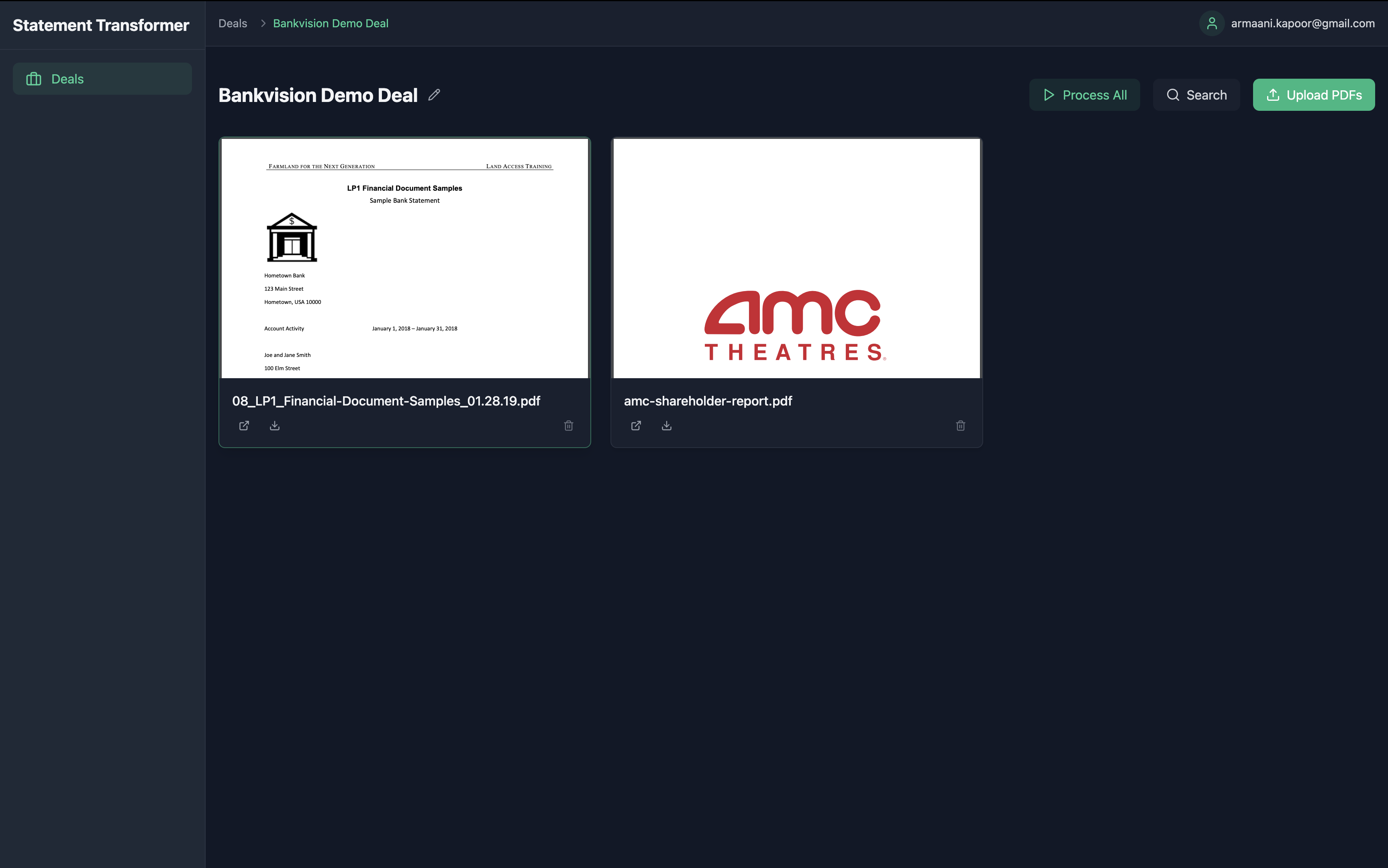

Step 3: Deal Overview

Once created, your deal appears in the dashboard with key information and status: The deal card shows:

The deal card shows:

- Deal status

- Number of processed statements

- Creation date

- Quick actions for processing and management

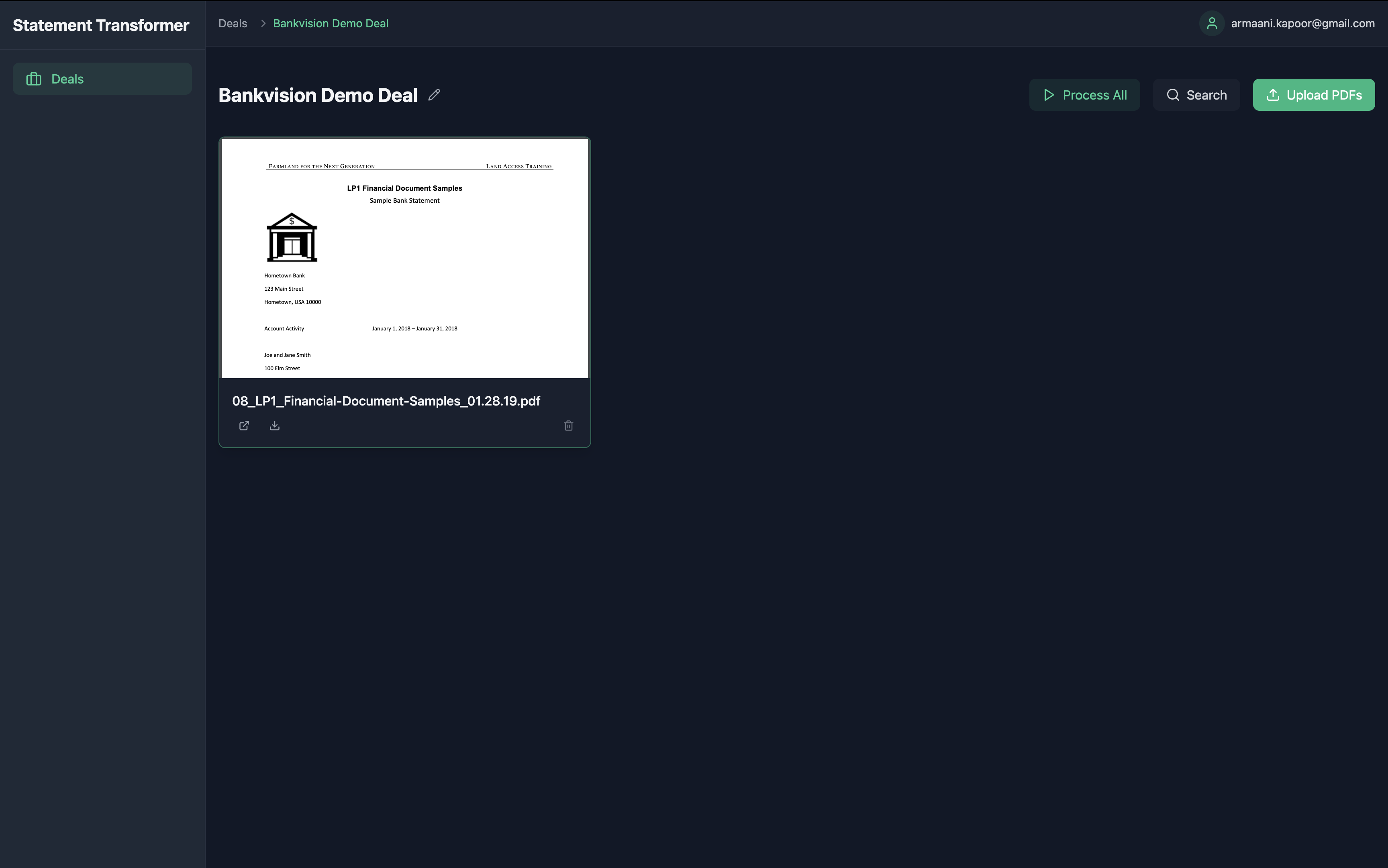

Step 4: Adding Documents

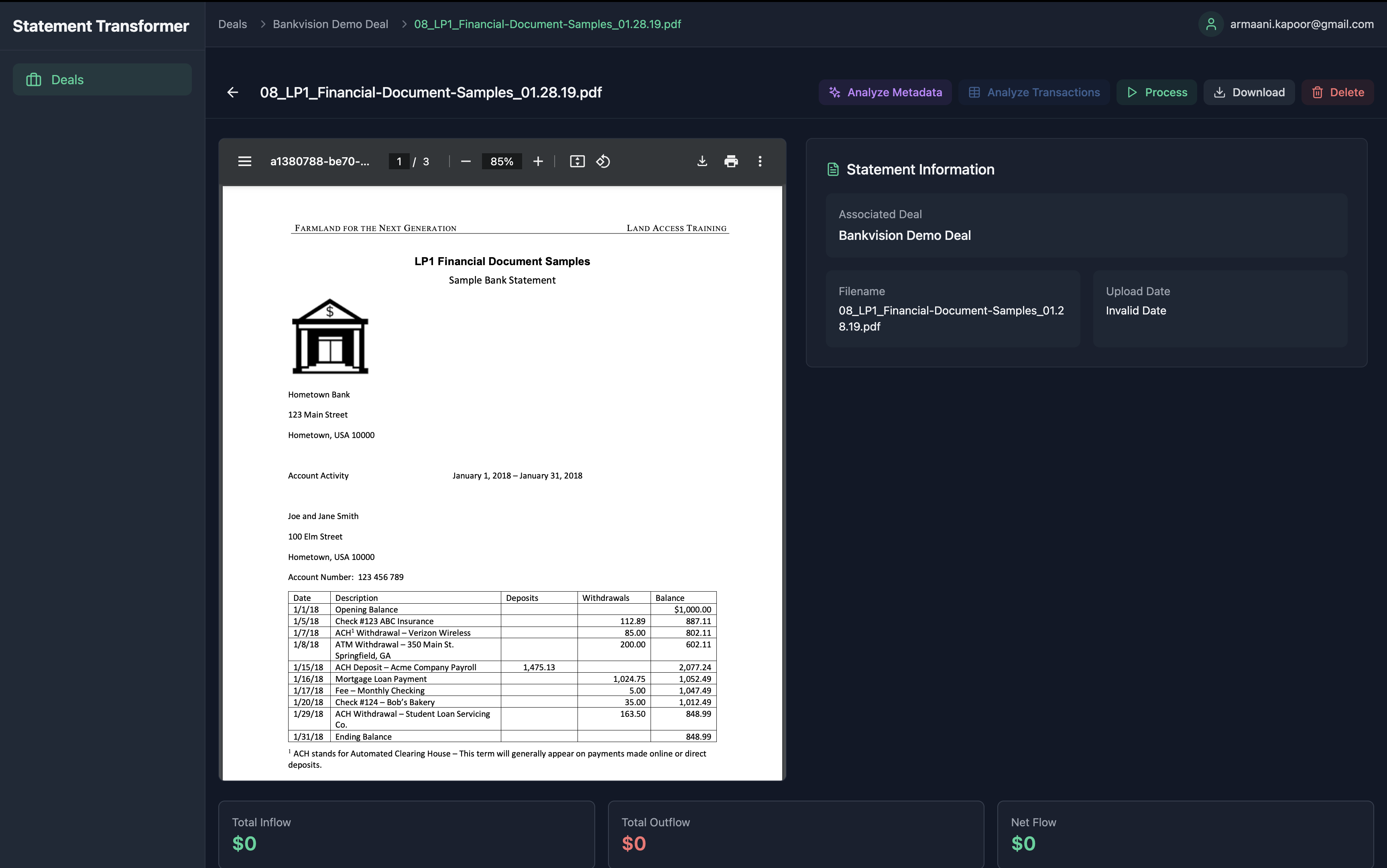

Now let’s add some financial documents. We’ll start with a sample bank statement: This example shows a mock bank statement (belonging to a fictional “John Doe”) that’s been uploaded to the deal. Notice how BankVision automatically recognizes the document type and prepares it for processing.

This example shows a mock bank statement (belonging to a fictional “John Doe”) that’s been uploaded to the deal. Notice how BankVision automatically recognizes the document type and prepares it for processing.

Understanding Statements in BankVision

Understanding Statements in BankVision

A statement in BankVision is a financial document—usually a PDF or image—that contains one or more pages of transaction history, balances, and financial records.

What Documents Are Supported?

What Documents Are Supported?

BankVision processes a variety of statement formats, including:

- Bank Statements (PDF, scanned images)

- Merchant Processing Statements

- Tax Returns & Financial Reports

- Other Business Financial Docs

How Statements Are Processed

How Statements Are Processed

Uploaded statements go through multiple processing steps:

Document Parsing

- Splits multi-page PDFs into structured records

- Extracts relevant text and table data

- Identifies key financial fields

AI-Driven Analysis

- Detects transaction patterns

- Maps cash flow trends

- Flags potential risks or inconsistencies

Why BankVision Treats Statements Differently

Why BankVision Treats Statements Differently

Unlike generic OCR tools, BankVision:

- Understands financial context - It doesn’t just extract text, it interprets transactions.

- Maintains document integrity - Multi-page statements are treated as a single financial record rather than separate, disconnected pages.

- Validates authenticity - Fraud detection catches manipulated statements before they impact underwriting.

You can upload multiple documents of different types to build a comprehensive financial picture. Each document is automatically categorized and prepared for analysis.

You can upload multiple documents of different types to build a comprehensive financial picture. Each document is automatically categorized and prepared for analysis.

Step 6: Statement View

Click on any statement to access the detailed analysis dashboard, where BankVision organizes and processes financial data.

Key Features

BankVision automatically organizes statements, grouping transactions by merchant, payment type, and frequency. This allows for rapid assessment and underwriting decisions.Statement Processing & Risk Analysis

- Transaction Analysis

- File Control Sheet (FCS)

| Field | Description |

|---|---|

| Date | Timestamp of transaction |

| Amount | Debit/Credit value |

| Merchant | Identified business or payee |

| Category | Payment type (e.g., rent, payroll, loan) |

| Deposit Source | Funding origin (ACH, Wire, Check) |

| Risk Flag | Highlights suspicious activity |

| MCA Payments | Detects recurring funding repayments |

Next Steps

Now that you’ve created your first deal and processed some documents, you can:Explore Analytics

Dive into detailed financial analysis and reporting

Configure Settings

Customize BankVision for your specific needs

API Integration

Connect BankVision to your existing systems

Security Features

Learn about our security measures and compliance

Remember: All examples shown use mock data and fictional entities. No real customer or financial data is displayed in these demonstrations.